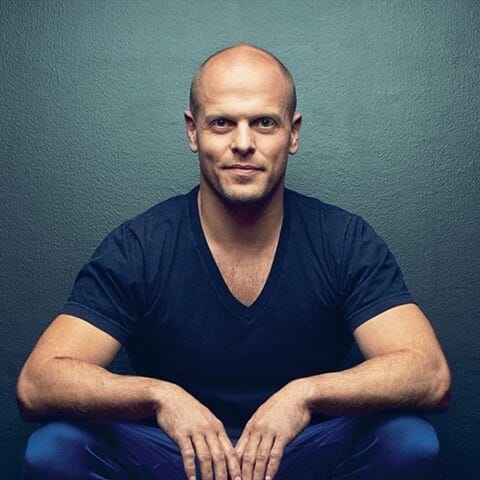

author

authorSeth Klarman

Seth Andrew Klarman is an American billionaire investor, hedge fund manager, and author. He is a proponent of value investing. He is the chief executive and portfolio manager of the Baupost Group, a Boston-based private investment partnership he founded in 1982. He closely follows the investment philosophy of Benjamin Graham. He is known for buying unpopular assets while they are undervalued, seeking a margin of safety and profiting from any rise in price.

Since his fund's $27 million-dollar inception in 1982, he has realized a 20% compounded return on investment. He manages $30 billion in assets. In 2008, he was inducted into Institutional Investor Alpha's Hedge Fund Manager Hall of Fame. Forbes listed his personal fortune at US$1.50 billion and said he was the 15th highest-earning hedge fund manager in the world in 2017. He has drawn numerous comparisons to fellow value investor Warren Buffett, and akin to Buffett's notation as the "Oracle of Omaha," he is known as the "Oracle of Boston."

Klarman was born on May 21, 1957, in New York City. When he was six, he moved to the Mt. Washington area of Baltimore, Maryland, near the Pimlico Race Course. His father, Herbert E. Klarman, was a public health economist at Johns Hopkins University, and his mother was a psychiatric social worker. His parents divorced shortly after moving to Baltimore.

When he was four years old, he redecorated his room to match a retail store putting price tags on all of his belongings and gave an oral presentation to his fifth-grade class about the logistics of buying a stock. As he grew older, he had a variety of small-time business ventures, including a paper route, a snow cone stand, and a snow shoveling business, and sold stamp-coin collections on the weekends.

When he was 10 years old, he purchased his first stock, one share of Johnson & Johnson (the stock split three-for-one and, over time, tripled his initial investment). His reasoning behind buying a share of Johnson & Johnson was that he had used a lot of band-aids (a product of the company) during his earlier years. At age 12, he was regularly calling his broker to get stock quotes.

Klarman attended Cornell University in Ithaca, New York, and was interested in majoring in mathematics but instead chose to pursue economics. He graduated magna cum laude in economics with a minor in history in 1979. He was a member of the Delta Chi fraternity. In the summer of his junior year, he interned at the Mutual Shares fund and was introduced to Max Heine and Michael Price.

After graduating from college, he went back to the company to work for 18 months before deciding to go to business school. He went on to attend Harvard Business School, where he was a Baker Scholar and was classmates with Jeffrey Immelt, Steve Burke, Stephen Mandel, James Long, and Jamie Dimon.

Best author’s book